Florida Attorney Helps Clients with a Range of Family Law Concerns

Handling divorce, child custody and other domestic law matters throughout the Sunshine State

For over 30 years, The Law Offices of Jodie Bassichis has been a pillar of support for individuals navigating the complexities of family law. With my decades of experienced, I understand the emotional toll divorce, custody disputes and other sensitive matters can have on you and your loved ones. From my office in Hollywood, I serve clients throughout the state who are looking for guidance in a wide range of cases. My goal is to guide you through legal challenges with clarity and compassion.

Quality representation in family law matters

-

Divorce

I fight for fair and equitable solutions in divorce proceedings involving child custody agreements, property division and child support calculations. I also work with clients who are looking to receive or avoid alimony payments.

-

Paternity

Whether establishing paternity for child support purposes or defending against false claims, I know how to navigate these cases with sensitivity.

-

Modification Orders

Life circumstances change, and so can your legal agreements. I advocate for modifications to existing orders, ensuring they adapt to your evolving family dynamic.

-

Prenuptial & Postnuptial Agreements

My firm works to help you secure your financial future and protect your assets with carefully crafted prenuptial and postnuptial agreements tailored to your unique needs.

-

Equitable Distribution of Property

In Florida, assets acquired and liabilities incurred during the marriage are considered marital property, and when couples divorce or separate, those assets are subject to equitable distribution.

Contact a Florida attorney for a free consultation

Facing a family law challenge can be overwhelming. Don't navigate this difficult time alone. The Law Offices of Jodie Bassichis is conveniently located in Hollywood, Florida is here to provide the unwavering knowledge and support you need.

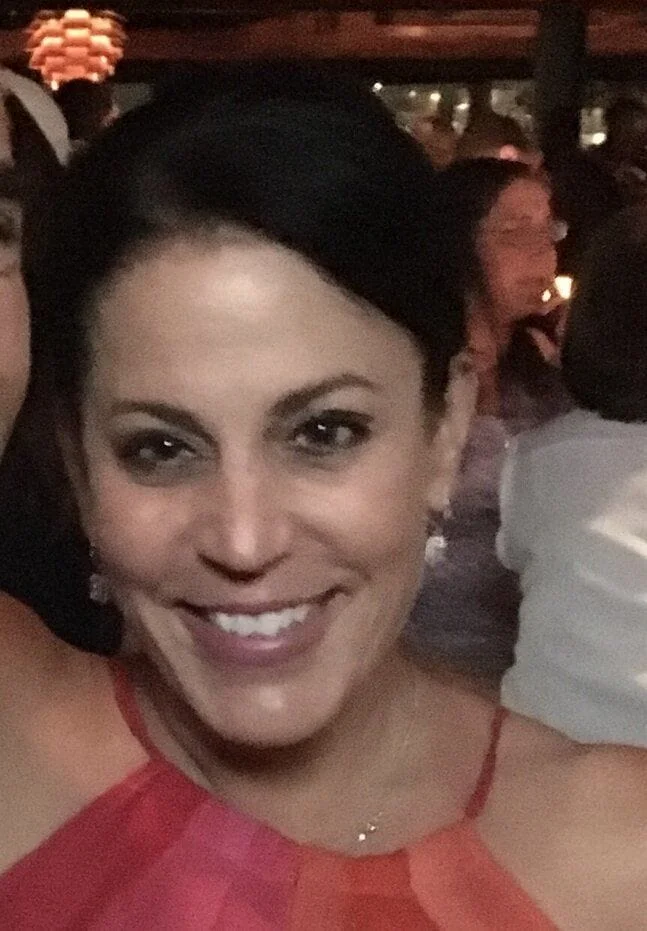

Our Attorney

-

Jodie Lynn BassichisManaging PartnerView Bio

Jodie Lynn BassichisManaging PartnerView BioAttorney Jodie Bassichis has dedicated her legal career to assisting clients in divorce and various family law issues since 1992.

The Law Offices of Jodie Bassichis

4000 Hollywood Boulevard,

Suite 727 South,

Hollywood, Florida 33021

The Law Offices of Jodie Bassichis is located in Hollywood, FL and serves clients in and around Dania, Hollywood, Fort Lauderdale, North Miami Beach, Opa Locka, Hialeah, Pompano Beach, Miami, Pembroke Pines, Miami Beach, Deerfield Beach, Key Biscayne, Broward County and Miami-Dade County.

Attorney Advertising. This website is designed for general information only. The information presented at this site should not be construed to be formal legal advice nor the formation of a lawyer/client relationship. [ Site Map ]

See my profile at Avvo.com

Martindale-Hubbell and martindale.com are registered trademarks; AV, BV, AV Preeminent and BV Distinguished are registered certification marks; Lawyers.com and the Martindale-Hubbell Peer Review Rated Icon are service marks; and Martindale-Hubbell Peer Review Ratings are trademarks of MH Sub I, LLC, used under license. Other products and services may be trademarks or registered trademarks of their respective companies. Copyright © 2024 MH Sub I, LLC. All rights reserved.